Recently, Tokyo Electron (hereinafter referred to as "TEL") announced that it will build a new production building in Miyagi Prefecture, Japan, mainly to produce semiconductor manufacturing equipment such as plasma etching to meet the rapidly growing demand for semiconductors in recent years.

According to TEL, the planned construction cost of the production building is about 104 billion yen. It is expected to start construction in June 2025 and be completed in the summer of 2027. TEL plans to turn it into a world-class semiconductor equipment factory.

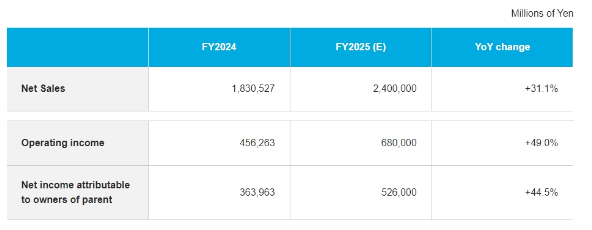

In addition, TEL also announced its 2024 financial report forecast on the same day. Data shows that in 2024, TEL will achieve net sales of 1.83 trillion yen, a year-on-year increase of 31.1%, and net profit of 363.963 billion yen, a year-on-year increase of 44.5%.

Semiconductor equipment market scale expands

As we all know, the semiconductor manufacturing process is complex, and the equipment required in different links is also different, mainly involving wafer manufacturing equipment, packaging equipment and testing equipment. From the perspective of process flow, semiconductor equipment is also divided into front-end equipment and back-end equipment.

Among them, the front-end process equipment focuses on the manufacturing and processing of semiconductors, mainly including thin film deposition equipment, etching equipment, photolithography equipment, ion implantation equipment, CVD equipment, cleaning equipment, CMP grinding equipment, coating/developing equipment, etc.; the back-end process equipment is mainly used for semiconductor packaging and testing, including testing machines, probe stations, dicing machines, placement machines, thinning machines, sorting machines, etc.

Currently, the development of industries such as artificial intelligence (AI), big data, and storage chips is driving the global semiconductor industry towards a trillion-dollar market size, which will undoubtedly provide semiconductor equipment manufacturers with more market opportunities and development space.

From the perspective of the market structure, the global semiconductor equipment market is still dominated by international giants, such as ASML, Nikon, Canon, Lam Research, Applied Materials, TEL, ASM, KLA, etc.

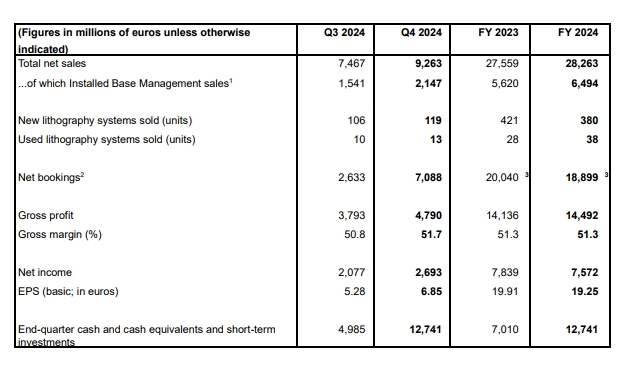

Among them, semiconductor equipment giant ASML announced its 2024 full-year and fourth-quarter financial reports on January 29. Data shows that in 2024, ASML achieved net sales of 28.3 billion euros and net profit of 7.6 billion euros, setting a new annual performance record. In the fourth quarter, net sales were 9.3 billion euros; net profit was 2.7 billion euros, both exceeding expectations.