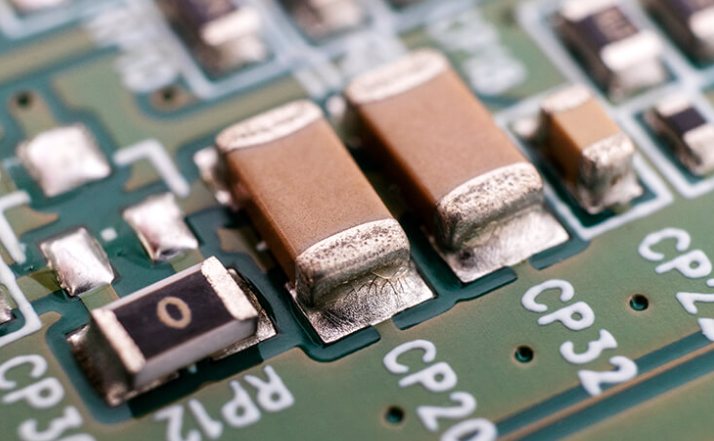

AI demand is strong, while the consumer electronics market is sluggish. As pre-consumption and stockpiling gradually subside, MLCC demand will be impacted to some extent.

Industry demand will be clearly polarized in the second half of 2025. According to surveys, orders from ODMs of mid- and low-end consumer products remained flat or only increased by about 5% quarter-on-quarter in the third quarter, and orders became more conservative. In contrast, AI Server orders are booming, and MLCC stocking demand has increased by an average of nearly 25% quarter-on-quarter. Orders and shipments of mid- and high-end consumer-grade MLCCs have also grown accordingly, which is beneficial to suppliers such as Murata, Samsung, and Taiyo Yuden.

Supply chain utilization rates are polarized, with capacity and inventory control becoming key.

Japanese and Korean manufacturers focusing on high-end AI applications have an average capacity utilization rate of 90%, while Chinese and Indian manufacturers are approximately 75%. The uneven nature of industry demand has led to significant variations in capacity utilization among MLCC suppliers, reflecting the continued stringent control of inventory and production capacity by most supply chains in the face of market uncertainty.

MLCC suppliers are accelerating the establishment of back-end testing and packaging lines in Southeast Asia to achieve localized production and supply. Under pressure from the changing international landscape, OEMs are expected to resort to repackaging through new bidding schemes, with upstream and downstream supply chain partners, including material manufacturers, original design manufacturers (ODMs), logistics, advertising, and distribution channels, sharing the high costs. This may even lead to higher end-user prices.